A home in Charlotte, North Carolina (Photo by Flickr user Lexie Longstreet via Creative Commons license)

Recovering from the housing bust of 2008 has been harder on some Americans than others, most notably older millennials, Hispanics, the upper middle class and the wealthy.

The 2008 financial crisis caused the greatest disruption in the U.S. housing market since the Great Depression in the 1930s, which was the lengthiest, deepest economic downturn ever in the Western industrialized world.

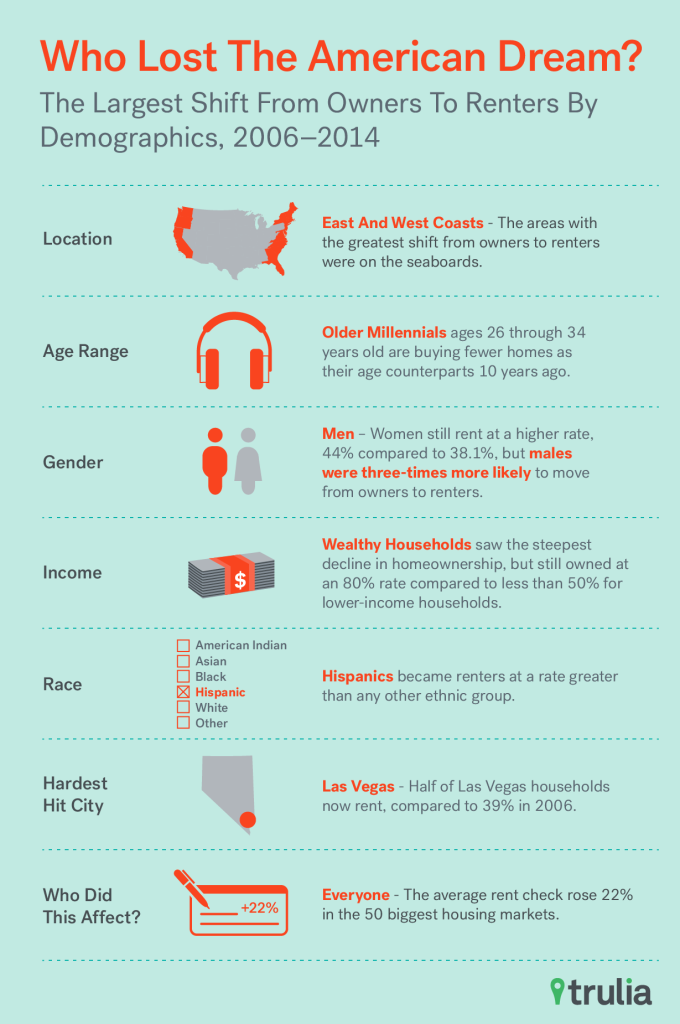

The housing website Trulia used data from the American Community Survey to determine where the largest shifts from homeowner to renter occurred from 2006 to 2014. The analysis explored factors such as age, gender, race, and income.

The housing website Trulia used data from the American Community Survey to determine where the largest shifts from homeowner to renter occurred from 2006 to 2014. The analysis explored factors such as age, gender, race, and income.

It found that young adults between the ages of 26 to 34, who used to be the prime group of first-time home buyers, were having more difficulty making the transition from renter to homeowner.

Svenja Gudell, chief economist for the real estate site Zillow, attributes this delay to the fact millennials are “figuring out how they can save for a down payment and qualify for a mortgage, especially while the rental market is so unaffordable all over the country.”

From 1980 to 2010, the average cost of a home increased 294 percent, according to an analysis from Job Application Center, making the prospect of saving enough for a down payment, as well as paying a monthly mortgage, even more daunting for potential new home buyers.

During the same period, Hispanics also became renters at a higher rate — nearly twice that of whites, African Americans and Asians — than any other ethnic group. The 2014 State of Hispanic Ownership Report found that home ownership was “lower than in previous years due primarily to a shortage of affordable housing inventory and competition from cash investors.”

“Three years ago, I had an extremely well-qualified millennial buyer who lost three contracts to cash investors,” said Megann Yaqub, a real estate agent in the Washington, D.C. area. “A cash buyer is more attractive to a seller. The transaction can close faster because funds are immediately available and there would not be a finance contingency as part of the contract.”

In the Washington, D.C. metro market, all-cash sales peaked at 42 percent in February 2011. However, by September 2015, all-cash sales had slipped to under 15 percent.

“Large investors are now leaving our market,” Yaqub said, “and this should create more opportunities for first-time homebuyers.”

The Trulia analysis also found that, conversely, upper middle class and wealthy Americans shifted from owning to renting at a higher rate than middle and lower-income households. Trulia finds this is likely due in part to the fact that “lower and middle-income households were already renting at significantly higher rates” than their more affluent counterparts. The wealthy are still doing OK. While more than 80 percent of rich Americans own a house, less than 50 percent of poorer citizens do.

Overall, the entire country is still feeling the impact of the financial crisis. In the 50 largest U.S. housing markets, the number of people who rent increased from 36 percent in 2006 to 41 percent in 2014.

More About America:

Who’s Losing Out on the American Dream?

Rare 1903 Footage Captures Busy Boston Streets

How Diversity Has Changed America

Millennial Men Prefer Bucks Over Beauty

Americans Can’t Always Name That President

Why Some US Muslims Still Plan to Vote for Donald Trump