It’s a highly coveted passport that represents freedom and opportunity to millions of people worldwide, yet more Americans than ever are renouncing their U.S. citizenship.

MORE ABOUT AMERICA

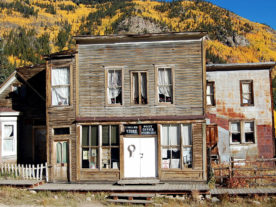

Wild West Ghost Town Emerges from Watery Grave

What Happens When Americans Tweet What They Eat

A record number of Americans — 1,337 — relinquished their passports in the first three months of 2015, according to the U.S. government. That’s up 18 percent from last year at this time, according to an analysis by Bloomberg News, and nearly 40 percent of the total 3,415 Americans who gave up their passports in 2014.

“It was a gut wrenching experience that I do not think I will ever be over,” former American Ruth Freeborn told reason.com. Freeborn says she is an average, stay-at-home mother who married a Canadian man and moved to Canada to help care for his elderly parents. She blames the Foreign Account Tax Compliance Act (FATCA) for forcing her into a decision she didn’t want to make.

FATCA, which was enacted by Congress in 2010, was designed to target rich Americans who use foreign accounts to avoid paying U.S. taxes, but it impacts ex-patriots at all income levels. FATCA requires that foreign financial institutions report financial accounts held by U.S. taxpayers to the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection.

The United States taxes its citizens on all income, regardless of where is is earned or where a person lives. This can lead to complicated and time-consuming paperwork that some ex-patriots complain has been made even more burdensome by FATCA.

“The cost of compliance with the complex tax treatment of non-resident U.S. citizens and the potential penalties I face for incorrect filings and for holding non-U.S. securities forces me to consider whether it would be more advantageous to give up my U.S. citizenship,” Stephanos Orestis, a American living in Norway, wrote in a March 23 letter to the Senate Finance Committee. “The thought of doing so is highly distressing for me since I am a born and bred American with a love for my country.”

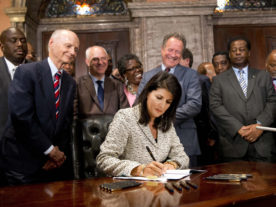

Facebook co-founder Eduardo Saverin, who relinquished his U.S. citizenship in 2012, speaks at a conference in Singapore on February 21, 2013. (Reuters)

More than 7 million Americans live abroad, according to the IRS. Many of those who have chosen to renounce their citizenship have limited ties to the United States. Some were born here but have lived elsewhere their entire lives. Anyone born in the U.S. automatically receives citizenship, as do people born abroad to American parents.

Eduardo Saverin, the Brazilian-born billionaire co-founder of Facebook, trimmed his tax bill when he relinquished his U.S. citizenship in 2012.

“I am obligated to, and will pay hundreds of millions of dollars in taxes to the U.S. government,” said Saverin in a statement at the time. “I have paid and will continue to pay any taxes due on everything I earned while a U.S. citizen.”

As Saverin learned, giving up U.S. citizenship doesn’t come cheap. There’s the $2,350 renunciation fee and an exit tax that can climb into the millions of dollars.

But some who have renounced have found there’s an emotional cost to giving up U.S. citizenship, which often goes to the core of Americans’ identity.

American-born Patricia Moon, who lives in Canada, renounced her citizenship not long after FATCA was enacted.

“I was terrified we’d lose all our money,” Moon, who became a Canadian citizen in 2008, told the Guardian.

But the decision to give up her American passport wasn’t an easy one. “It was like cutting off my right arm.”

If someone wants to give-up their American Citizenship, that is their right. I have struggled in the in this country all of my 73 years, served in the U.S. military, had a brother die while serving in the U.S. Marine Corp, and nieces and nephew serve in the military recently and currently. None of them will never be wealthy, but will pay some taxes. I had an uncle that served during WWII in service to our country and for our worldly friends and for those that don’t want to pay taxes. My uncle lived and died in poverty!

Take your money and go some where that the sun does not shine! I hope that there are laws that prevent the ungrateful from begging and crawling back.

Sir, your comments are ignorant. We pay more than our fair share of taxes, much more than Americans at home. My marginal tax rate is 47.5% and I pay a 15% VAT. Trying adding 15% to a car purchase. We are not tax cheaters; we simply want the same rights and freedoms all Americans living at home have. All of my income is Canadian. It is generated in Canada by Canadians. It is 100% Canadian money and arguably America has no rights to it. Every dollar taxed by America is a dollar robbed from Canada. It is increased Canadian debt and lost Canadian jobs, all for the benefit of reduced debt and increased jobs in the land of the supposed free.

Citizenship does not come with a price tag sir. You cannot buy it or sell it, and there are no strings attached. Forcing us to file a second set of taxes, restricting our investment options — I cannot legally buy Canadian company shares even though I am a Canadian citizen and my life insurance cash value is nothing but a savings account — forcing us to overspend on tax help (there are no US tax experts out here in the wild), killing our ability to minimize our income tax burden (save in Canada, pay in America), and taxing money used to support my Canadian (non-American) family is far, far, far overstepping the bounds of sovereignty and is in effect a giant price tag on our heritage. It is not worth keeping.

And don’t think for a minute we are not patriotic. We are fighting tooth and nail to change these laws. And people such as yourself, decorated service personnel, are also relinquishing. The stories of these people is heartbreaking because they have no other choice. They have to protect themselves and their families before their countries. You would do the same sir. You would do the very same.

If you are going to blame anybody, blame your president and his party. They are the ones calling us tax cheats and then cheating us and cheating our adopted countries. It is shameful, and I am not proud to be an American with such treatment of its citizens and foreign nations.

There are better ways to stop tax cheating. Other countries stop money as it leaves. It makes a lot more sense than tracking people around the world and making them own up for something they should not have to even consider. It’s like making people pay state taxes for every state they’ve ever lived in. If the rest of the world had adopted this process, over 40 million Americans would be filing tax returns with foreign countries and pumping money out of America. 11 million Mexicans. Russians. North Koreans. Chinese. The American economy would be in ruins and world trade would collapse. Citizen-based taxation is as stupid as stupid can get.

Face another fact. America is hated around the world. Maybe it’s justified and maybe it isn’t, but American citizens like me should be helping its world image. I should be saying how wonderful a country it is at water coolers and coffee shop. I should be wearing red, white, and blue at pubs. I should not be embarrassed to fly an American flag on flag day. Yet right now I can only curse my country of birth. She treats me as a criminal for trying to live the life my neighbors do. When talk of America comes up, I am the first to throw flames on the fire. And I am not at all happy about it. I am better off relinquishing my citizenship and washing my hands of the evil empire.

My uncle Cope walked out of Inchon Reservoir and earned a Silver Star. I proudly store my grandfather’s burial flag. Yet I am not at all proud of my country.

John,

By carrying a U.S. passport you carry the protection of the U.S. where ever you travel. Yes, there are countries out there with standard of life equal to or better then that of the U.S., but do they offer the same protections. If you are happy wherever you are then by all means stay there. If you feel that U.S. Citizenship grants you no benefit and is only an expense then the choice to give it up is yours. I wish you luck either way, but while you are a citizen of this country then PAY YOU TAXES!!

You spoke of all the additional taxes you pay to your new country, but you left out.

State and local income taxes (in the U.S.) that you do not pay!

Sale and use taxes in the U.S. that are not accessed.

Various license and other fees that the Federal, state and local govern may charge for certain services.

What is so special about American citizenship that I should pay taxes if I live in another country? Why does no other country do this? Take your red, white, and blue blinders off and think. These taxes are crippling not only citizens but nearly a million small and medium businesses then run. It is tough enough to compete in this world, but the additional tax burden is very, very heavy.

These are all the American services I benefit from:__________. I have a Canadian passport. I will get Canadian social insurance instead of social security, I drive Canadian roads, my kids go to Canadian schools, and my wife and children are all Canadian and non-American.

Where’s the logic in making me submit all my financial information under the threat of a $10,000 fine per omitted account plus 50% of its value? Millions of Americans have never filed taxes from abroad because it is stupid, and now their livelihoods are seriously threatened.

Don’t give me this patriotic, flag waving crap. This tax is about catching tax cheats and it is the wrong tool. It might have made sense in 1862, but it makes zero sense today.

We do have the constitutional right to live abroad, and these taxes severely impinge on that right. It is worse than the tea tax that “taxation without representation” was coined after. Did you forget about that party? Have you forgotten your American values?

I haven’t. I just want to live a free, competitive life. I cannot do that with these laws.

Passports provide zero protection. Just look at the stranded Americans in Yemen and Nepal. If the United States should ever rescue me, they would charge me for their services. My taxes mean squat.

US citizens had to depend on other countries for help leaving La Paz, Baja California after the hurricane last year.. Even if help were given you will receive a bill.

So you live in MA and you move to NH. I assume you are willing to pay taxes on everything you earn in NH to MA for your entire life. Then you move to FL. Okay, everything you earn in FL is also subject to MA taxes. You did once use their roads.

I believe taxes are the price of a civilized society and I happily pay taxes where I live. I get great roads, great health care and there’s a good education system. Why should I pay taxes to a place I haven’t been for years and never intend to go again just because I was born there? If I lived in the US I would expect to pay taxes there.

“t”, you simply don’t know what you are talking about when you say “but while you are a citizen of this country then PAY YOUR TAXES!!”

What you completely fail to understand is that it is not even the darn taxes (unjust though they may be, and in some cases even cruel: for instance, I bet you didn’t know that the US taxes EVERY dollar of any disability payments received from other governments, did you?) that we are unhappy about! The DRACONIAN dragnet put in place by the US government is literally destroying the lives of almost every American living abroad long term. No other country does this to its citizens (except for the thuggish dictatorship of Eritrea – and, frankly, I would LOVE to have the tax regime that those “lucky” people have). Immigrants who live in the United States DO NOT pay taxes to their home countries, and they are not stalked by their governments like we are. Yes, literally stalked.

I respectfully suggest that you listen to others when you don’t know the issue (by all means, ask question!). Read some of the other comments here about what our lives are like. Click on the link in my other post about who we are. If you keep your mind open, I think you will be shocked.

By the way, for what it’s worth, I was in the military too – like so many others commenting here. And, as you can see, after our service, we feel let down by our unfeeling treatment by our own government (which can’t even claim “unintended consequences,” because they have known about our serious problems since at least 2011, which puts their inaction in the WILLFUL category as far as I’m concerned)

Nearly all the Americans living abroad are paying their taxes. The problem is that they are abusive and discriminatory because of FATCA.

If you buy a mutual fund in the US and then sell it you would, at most, pay 20 percent tax. If you have saved all your life in a foreign mutual fund (with no advice from your Government not to) and sell it, under FATCA you pay nearly 50 percent tax for being honest and a good citizen. BTW there are also local and city taxes in other countries that we must pay PLUS huge VAT taxes. so our tax burden — even with FATCA — is already high. The Fourteenth Amendment says all US curtness should be treated equally — FATCVA violates that protection by discriminating against those living abroad. The issue is not that expatriate Americans do not want to pay their taxes!!!!!

What kind of protection does U.S. citizenship offer? Did it help the U.S. citizens trapped in Yemen? No, U.S. citizens had to rely on countries like Russia and China for help. What about Americans trapped in Nepal after the earthquake? They were advised to contact the Australians, Chinese and Indians for help in evacuating. Did U.S. citizenship help any of the Americans held by ISIS? All the French and Germans that were held by ISIS are home with their families, while the Americans are rotting in graves. The U.S. Government often abandons its citizens overseas, and on the few occasions it does come to the rescue, it leaves you with a huge bill while other countries consider it part of the services you pay taxes for.

Stop beating the whole ‘what does US citizenship give you’! The current actions you are referring to is the current administration. The same administration that allowed a US woman humanitarian to be murdered by ISIS, yet traded 6 high-valued terrorists for one Army deserter.

Come on John, really? First, you gave up your country for money. Second, you are not proud of your country. And finally, pay attention here, your country is NOT YOUR GOVERNMENT!!!! It is the people, the people you left behind, all of us. By the way, people can’t fight to change laws in the US if they abandon their citizenship. You think we are all really that ignorant? Did you even read this article? I checked your figures of taxation of foreign incomes……………..LIAR! Wish I was paid with forgeing currency.

oooops, “foreign currency”….typo

BOL, thank you for your service in the US military. I also served in the US military and I am also not wealthy and I pay taxes. Yet, I renounced US citizenship in response to discrimination to refinance my mortgage.

Most of the people who are renouncing US citizenship are not going anywhere. They have lived abroad for decades and will continue to live where they live, just as how I renounced to live in my home where I live. These people are of all income classes with various cultural backgrounds and they come from all political affiliations. Most are not wealthy, just as I am not wealthy. Where they live, the sun doesn’t always shine, but it does shines too, just like how it does the same in America. Life is not always easy when living abroad and many of these people struggle, just like America. Yet, they do not beg anything from America and cost the US taxpayer nothing. They receive no benefits from America, have no political representation and every American service that they use, they pay extra for. As such, they do not beg from America, will not crawl to America and simply ask that you be polite to fellow comrades living abroad, show them respect and allow the jurisdictions where they reside to dictate which rules they must follow, just as how you defended America from being dictated by the laws of foreign jurisdictions.

America may write any law to its heart’s delight, but it is American extraterritorial law which is causing this discrimination which is leading to these renunciations. Writing more bad law to punish innocent Americans further in response to bad law already written simply strengthens the problem, causing you to become even more hostile towards those Americans whom you previously fought to defend. Instead of opposing Americans for responding to bad US law, why not focus on the bad law which is the problem instead?

I see a lot of Veterans posts, so first I would like to thank all of them for their service. I served for 20 years in the U.S. Army and I am very proud of that fact. Now, having said that let me say this. I have never met a rich person that served this country, or that had their children serve this country. For some reason they think they are too good to do that, let the poor do it. If you don’t like the tax rate and you want to renounce your citizenship, good! Pack your stuff and don’t the door hit you in the ass on the way out. No one needs or wants you here. This feudal bullishness of not want to pay your fair share of tax is crap. So go ahead and leave, but don’t look back and don’t ask to come back, your spawn as well.

Anthony Forrest, some American veterans are renouncing and not all of them are wealthy. Do you think that there is a chance of the problem being the US policy which put them into this situation, rather than the problem being American veterans?

This has nothing to do with the American tax rate, since the American veterans who are renouncing do not live in America and usually don’t earn enough to be double-taxed by the US government on their local non-US earnings and they all pay their fair share of taxes. Also American veterans would rather not renounce US citizenship if US policy was written differently.

Why do you write that “nobody needs [American veterans] or wants American veterans] here”? That doesn’t sounds like a “thank you” for their service.

Ahhhhh.

Recall the bumper sticker “America: love it or leave it” from the 1970s?

Well, since you dislike the way people are making their choices, why don’t YOU leave.

Nobody cares about your age….

Nobody cares about your military service…

Nobody cares about your loyalty to a corrupt and failed system of government.

People are sick of this failed system of government …. which is now so desperate to pretend its

viability that it has to use military weapons upon its own citizens and spy upon EVERY INNOCENT

citizen in violation of the US Constitution and in violation of laws… as per the recent ruling by the

Federal Judge that declared the NSA spying “illegal.”

Bob. It’s clear your family had limited professional options hence the military; most enlisted hail from lower/middle income families for the most part. However, you shouldn’t expect ALL Americans to empathize with your dedication toward your indoctrination. You and your military brothers and sisters have a dangerously skewed view of the world and really should have figured it out before turning 18. In any case, you served, and you certainly believe America is the best thing going.

Unfortunately, the poor in the USA know the US is not number one in wealth, science, education, and medicine regardless of what the partisans tell them on nightly news…and the “middle class” is still busy occupying itself with the image of ‘class mobility’ into the elite to pay any attention to the realities of overreaching tax laws or non-living “person” entities that cause the lion-share of the social problems in the US.

In addition, as long as the Central Bank (Federal Reserve= neither “federal” nor “reserve”) persist to hypnotize the confidence of the masses in believing fiat currency (or upcoming “NFC credits”) have any intrinsic value, the masses will preoccupy themselves with whatever scheme of money substitutes to eek out a daily existence of debt, in order to simply accumulate the “tokens” in exchange for risking all remaining sovereignty left to the idea of a USA. Do you even realize an abundance of foreign countries have signed an agreement to cooperate with the IRS in tracking US Citizens abroad? The stories below the article are painfully real to the posters, so given your history and your family’s diligent dedication to service in the military, do not dismiss their plight with the US tax laws or the unfair burden these laws (that don’t affect you personally) have imposed upon their lives and liberties as humans.

By the way, Bob…don’t expect a thank you from me. While I empathize your family must live with the life chosen, really–you’ve only shown you are good at “doing what you’re told irrespective of the reach of either your actions or those of your employer.” Do not project your opinion into the Article that affects a growing number of American Citizens abroad, and I will do the same.

Brilliant opinion BOL. at least we may hope that the US is not a safe place for them to launder their money without paying a price.

US Citizen, Americans living abroad (those renouncing) bank locally and thus have no need or reason to hide money in American banking secrecy. Are the hidden savings of people living in America being properly and fairly reported to other nations as required with FATCA reciprocity agreements? Fix local problems instead of condemning the innocent for the wrong reasons.

Expats pay taxes where they live AND to the US, which is the only one of two countries to require that. There are huge penalties and often spend thousands to stay in compliance to discover they owe nothing.. Thanks to the US bullying the banks, American expats are finding themselves shut off from all banking services, their mortgages being called in, etc. To BOL, If you live in place where you were born and moved from there would you be willing to pay taxes in both places although you only lived in one? Would you be willing to live without a bank account?

If yes, then I understand your comment. If no, try walking in our shoes.

Even though I gave up my citizenship three years ago to have a bank account, my bank called me in for the sin of sending $300 to my stateside daughter. I proved AGAIN I was no longer American so I could continue to have a bank account. Would you like to live like that?

See, once again, people like yourself have no idea what citizenship means. It is not your government, it’s us, all of us that makes your citizenship. That’s the topic here and why people are giving up their citizenships. They are doing so because of the government. Our government (lame as it is) is not my citizenship, we are our citizenship…..NOT THE DAMN GOVERNMENT! When people insult America, they insult you and all of us, our children and mothers too. If people insult our government….then get in line…we all feel the same!!!! When Iran says, ‘death to America’, it means death to my children, all that I love, and people like you! If they said ‘Death to American government’, then so what, hwatever, who cares. Like to see someone try it, they may regret it. We are citizens because of all those that sacrificed for us, whether military, labor strikes, civil rights, etc. These are the people that have made us the CITIZENS we are today and definitely not the government. Give up on the government all you want, I’m with all of you in that aspect. But giving up your citizenship is giving up on all of us!

@ BOL – Hi, my family also boasts of military heroes who fought for the US. They fought for OUR rights. One of those US legal rights and human right is the right to change citizenship. Of the people I know who are renouncing and relinquishing US citizenship (several dozen), NOT ONE is doing it for the taxes per se. Many, like myself, have paid taxes to the US for our entire time abroad (in addition to the taxes I pay to my host country for services that are actually provided to me) and are renouncing now for survival, financial survival and survival of our family as a unit (in some cases I have heard reports of the American family member returning to the US, forced by US overreach to abandon his family). Only recently did the US enact FATCA, a highly intrusive law forcing Americans overseas to provide details about their finances that Americans in the homeland would never agree to. It also requires that the details of their non-US spouses be provided to the US gov’t as well (if they have joint accounts), in clear violation of many other nations’ privacy laws. We cannot have normal lives due to FATCA: we cannot be partners in businesses in our host countries, we cannot use investment vehicles such as mutual funds to save for our retirements, any investments we do manage to make are double taxed. Our checking accounts are being closed and our mortgages are being called in due to the effects of this law. Our non-US spouses are suffering greatly because our government has made us the cause of these serious problems. Many are likely wishing they had never met an American and fallen in love. We ARE NOT champagne-swilling, yacht-sailing billionaires. This is who we really are:

https://americansabroad.org/files/8613/5972/6757/acapiecejan2013.pdf

The US is the only country in the world (besides the thuggish dictatorship of Eritrea – great company the US is keeping!) that requires its citizens to pay taxes to it when they reside somewhere else. You must understand that we ALREADY pay a full set of taxes, which are generally MUCH HIGHER than what we would pay in the US, to our host country for the infrastructure and services that we actually use: bridges, schools, health care, etc. The US provides us with NOTHING, but we are still required to pay taxes to it. Immigrants who live in the US pay taxes ONLY to the US. Do you see what I’m saying?

And, unfortunately, you may very well get your wish: legislation may very well be enacted to prevent us from returning. I will be deeply saddened if that comes to pass, because it will break the heart of my elderly mother who cannot travel. And when she passes, I may not be able to attend her funeral.

Little of the media coverage of FATCA conveys exactly what motivates many expatriate Americans to give up their citizenship in recent years. The law institutes a tax rate on foreign held accounts that is abusive beyond belief. It treats capital gains as though they were earned income yielding cumulative tax rates as high as 50 percent. If you had your life savings in a foreign account — even if you declared it fully to IRS — you could be subject to this abusive tax when you sold portions to cover your retirement. The intent of FATCA was good — to punish people who hid accounts abroad. But now it is punishing people who live abroad for work, faithfully declared all their accounts to IRS, and just saved like any responsible individual. American expatriates should not have to choose between a safe retirement and their US citizenship. The Congress needs to correct this abusive mistake. The irony is that IRS will likely lose tax revenue in the long run as more people flee

to save their retirement accounts. Yes, US hedge funds and other morally dubious entities have hid accounts abroad — punish them and not some ordinary citizen saving for his/her old age.

Very well said, thank you. I would also add that FATCA is causing many banks to deny services to Americans. Personally I was denied a mortgage simply due to my American citizenship. Many banks limit or deny retirement accounts as well.

There is a fee to give up your citizenship???? Wow if that is not the best example of over regulation ever I don’t know what could be.

the cost of buying our freedom is $2350. Multiply by four if it is a family of four.

Bull. Read the other replies. What is really ironic is that if you read the history of FATCA, there was an amnesty for all the hedge funds and super-rich who held secret accounts abroad. They paid a fine and repatriated money from hidden accounts instead of going to jail. Their names were not even published, But if you had a mutual fund abroad and declared it each year, you were socked with the same tax rates as the criminals who did not declare them (up to 50 percent). Talk about a pro-rich tax policy!

The cost of buying freedom is indeed $2350. This is the huge fee the US charges Americans living abroad who seek to liberate their lives from the hostilities, restrictions and burdens coming from America. No other nation in the world treats its citizens with so much hostility and no other nation in the world charges them so much money to become liberated from such.

While FATCA is kind to the super rich, especially those living in America, it is unusually harsh to the poor and middle class abroad who are trying to get by from pay check to pay check.

FATCA is indeed pro-rich tax policy! Over half of Congress is a millionaire.

It’s not BS. It is indeed $2350. Look it up if you don’t believe it. A simple google search will confirm it.

The problem is when people go to countries with no tax agreement with the US.

The US is the only country that taxes you while you out of the country.

If you live outside the first $95000 is tax exempt.

Why they did not use another method is puzzling.

Tax exempt from the US – Yes BUT NOT Tax exempt in the country where we reside and often times taxed at a higher rate than if one was living in the US! So NO the money is NOT tax free!!!!!!!

Only regular earned income is exempted. Investment income, capital gains and other types of income is not exempt and often are not included in tax treaties. So those types of income are often double taxed, and at punitive rates.

The problem with IRS tax law with compliance agreements with virtually every country: it simply did not exist prior to either 1913 or the Federal Reserve Act. Why do you suppose that might be?

How can people who are old and should be enjoying their retirement, got to work more to keep food on their table? Personally, I will stop working and collect pension living abroad. I paid taxes while working, and my retirement is taxed again. Is stealing if I get double taxed. Why not to give up the US PASSPORT if I’m double taxed.

Not true. I live in Japan but am not rich. I have to do the FBAR every year. I pay Japanese taxes yet must do the 1040 and 2555 every year.

Now thanks to Obama I must do another form that I opt out of US health insurance. What a waste of time.

I got audited by the IRS, even though they had to admit their error.

Most American people abroad are not rich.

Dear Bol,

Your family has clearly sacrificed for the US, and you should be proud of them. My family is much the same: father was in the navy during Vietnam, his father was in a submarine and fought Japan in WW2, my brother was in the army, my best friend was in the marines, not to mention all the other uncles, cousins, etc. who served. Heck, my cousin was even a member of Seal Team 6 before he was killed in Afghanistan. I think that if you and I really got into it, we’d have a hard time showing who’s family spilled more blood for red, white, and blue.

Here’s the problem. None of what this article is about or the race to give up US citizenship has anything to do with patriotism or love for country. I’m very happy to be an American. However, as an expat with a non-US citizen wife, I’m in the same situation as some of the people in this article. It’s a terrible situation that would take more than this post to fully explain to you, but I want you to know 2 things about the majority of expats, including the majority of those giving up their citizenship.

1) We have no US tax liability. The “Standard” income exclusion on foreign earned income is about $100,000 per year. In fact, for the first time ever, this exclusion has surpassed $100,000 for fiscal year 2015. The vast majority of expats do not make enough money to even have tax liability in the US, so this is not an issue of us trying to not “pay our fair share”. It’s a question of being harassed into filing an absurd amount of paperwork (each with fines and penalties for mistakes that easily reach into the hundreds of thousands of dollars with no link to the amount of money in the accounts being taxed). I left the US at the age of 26. I had no problem paying US taxes and had the EZ form mastered. I’d do my taxes, determine my 401k contribution, recalculate, and send everything off with a smile in one afternoon. Sadly, that’s not the case for an expat. I’ve spent around 20 hours since January researching all the forms and documents I need to file in order to be compliant for 2014. My to-do list is as long as my arm, and all so that Uncle Sam can get his pound of flesh. Wanna know how much he’s getting for all my work? 0 dollars. Yes, ZERO. I don’t make enough money to have US tax liability, but I do have something near $200,000 dollars of potential fines should I mess up one of the 12 forms I need to file. If I’m lucky, a mistake will be seen as ‘honest’ and not ‘fraudulent’, which would reduce those fines to a measly $50,000. Lucky me!!!

2) We are heartbroken when we realize that our citizenship has become a luxury that puts our family’s financial security at risk. Between the maze of impossible rules governing tax-deferred retirement savings and the added complexity of getting those accounts recognized as tax-deferred, most of us expats just give up on saving for retirement. For example, my retirement savings, which are identical in behavior to a 401k in the US, are treated as a mutual fund by the US. So all the benefit of saving that money for retirement is lost when I submit US forms. I’m taxed by the US on my retirement savings as if it were income. That might not sound like a lot, but added with a thousand other financial cuts you take at every turn it’s only a matter of time before your wife asks you, as mine has, “is it really worth it to stay an American when it’s going to prevent us from saving for the kids’ college and our retirement?”

Before you read a story like this and just assume all expats are tax-dogging, anti-American, worthless whiners, I want you to look at that wonderful family of yours that has so well-served the US in times of war, and tell me if you’d risk their retirement, financial well-being, and quality of life just to keep your passport. Would you? Are you that selfish?

I’ll probably have to relinquish in a few years because FATCA is causing the death of the ability to reside abroad. Banks don’t want US customers because the financial risks are too high, mortgages are denied or canceled, reporting and staying compliant is such a nightmare, the list goes on and on. At the end of the day, I owe my wife and kids the best life I can give them. Sadly, because of some extremely short-sighted politicians in Washington, I can’t do that as an American citizen anymore.

So before you judge, try to understand that our government is causing people to go through hell, and their only escape is to turn their back on their country. Since that’s not something you know anything about, maybe you shouldn’t rush to judgement.

-American Expat since 2009

Great post.

A kernel problem exactly as you point out is that you have to contest your penalty or affiliation; since failure to do so is consent by silence. I am wondering if this has to do with your volunteering or petition for a SSN, or if the problem occurred the instant your parent under duress of childbirth, raised her standing to file for your birth certificate on your behalf?

The birth certificate is a bond, correct? And the SSN allows you the privilege to work in public sector. There is private sector, you know. Unless you want to work for a boss in exchange for Federal Reserve Notes that were not issued by the US govt, but the Central Bank called the Federal Reserve (neither ‘federal’ nor ‘reserve’)

The hassle you’ve experienced, in this light is perfectly understandable as it is unfair.

But I enjoyed the lucid synopsis as you’ve provided absent the kernel of the bond and the consideration you have received in exchange for your SSN. THINK PEOPLE before it is too late.

Unless you are a criminal, no reason to do this.

Yeah! This is ‘Merica! If you don’t like it you can get out!

To enable Americans to leave, you have to drop the renunciation fee, the exit tax, tax demands and drop passport blocks. It might also help to make agreements with other nations to expedite citizenship for American refugees and the US government could cover any costs for acquiring a non-US citizenship. All of this would make it much easier for you to get rid of Americans.

We need to think less about money and more about life. All the people have the right to have what is essencial to life on that planet, not just the North Americans. Just one observance: I’m an american too (South American).

This article doesn’t explain that because of FATCA, the worst Act ever, Americans can’t open bank accounts overseas–the first step in growing your business in foreign markets is opening up a bank account. So this has massive implications on not just the millions of Americans outside of USA, but for the entire global economy because everything is connected.

In my case, being a small, innovative business, I tried to expand into overseas markets (like any good entrepreneur should, right?). After initially investing in market research and conducting foreign visits, I was ready to open a bank account to begin the small-scale expansion. Lo and behold, I was chased out of every bank because I was American! They will NOT allow American clients because of FATCA.

My expansion plans are dead, opportunities lost all because of this disastrous Act.

I have no intention of renouncing my US citizenship, but my story is just as important in exposing the seriously negative effects of FATCA.

The U.S. did not evacuate its citizens in Yemen like many other countries did. Even when they do the evacuee has to pay for the service. An expat gets only the right to vote for the taxes paid and sometimes those votes are not counted. If you were an accidental American and never lived there even voting doesn’t seem like that important if you can’t have a bank account.

Many commenters, as usual, don’t understand why people do that. I am sure every single American living abroad wouldn’t mind continuing being a US citizen if they could, but they have realized it interferes in their daily lives. I mean who would to have their bank called them and say, ” Your government is forcing us to spend money and report your account balance to them. As a result, we’re closing all your bank accounts since we have no time or energy to spend on this.” And it has happened.

I read a story, among many others, about this US citizen who was born in the US because his father was studying there at the time, but the father returned to France, his home country, 5 months later. He never lived in the US or even visited the country as an adult. One day, after FATCA was implemented, his bank called him and told him they would close all his accounts unless he can prove he isn’t a US citizen. I read two other similar stories.

I decided to check and I have found out that many banks abroad actually ask in their application if you are a US citizen. Out of curiosity, I started an application with some banks in France. One of them flat out said they can’t open a bank account and you click more information there is a detailed text about what FATCA law is and they can’t approve your application as “‘you indicated you have one or more index of americanism.” lol.

I mean come on who wants to go through that? Who?

The FATCA requirements should be completely dissolved. I suggest writing your congressman and Senators and getting this removed while Republicans are in control. There isn’t a chance in hell of it passing if Democrats are in the majority. It is onerous, self-defeating and unjust. WRITE YOUR SENATORS AND CONGRESSMAN AND VENT TO THEM.

Mike

Its not hard to believe to me that people are abandoning the US citizenship.

The government steals everyone’s money to fund its:

1) army of government public employees cozy retirement system at only age 50

which is a full 17 years before private sector workers can ask for social security.

2) to fund its war mongering tactics around the globe wherever they cannot

bribe some foreign government to cooperate. Sticking their noses into foreign

CIVIL wars like they did with Vietnam…. while government “officials” keep THEIR

kids out of combat and out of the military.

3) The world looks with disdain upon America. Google the photo of Vice President Biden

visiting Japan (China?) last year and how their government official is looking at Biden like

he is mentally ill …. .yet the 2nd in command of the US Government. Amazing.

Put your faith in GOD and not in your money.Our forefathers founded America on GODS word.The Love of money is the root of all kinds of evil.

Time For America to Join the Rest of The Developed World and Adopt: Residence Based Taxation.

Americans in the US trumpet how great their freedom is. However the freedom of Americans is inferior to the freedom enjoyed by citizens of many countries such as Australia, Canada, and the UK and this freedom is this: the freedom to work and live in another country, and the freedom to leave one’s country.

America’s tax and compliance laws have increasingly acted to keep Americans in by punishing harshly those who have left.

Those impacted very much are part of the 99%, most part of the lower and middle class. If you are a US person living overseas, and there are 7+ million, then you are already getting taxed in the country where you live and receive government services. You receive $0 in US government services, other then those paid for on a fee basis. The US with Citizenship Based Taxation wants to tax you as if you live in the US. The US allows tax credits for your taxes paid in your country of residence. The conundrum comes in where the US has taxes that your country does not, then this flows on top of all taxes paid as double taxation; a more technical term for this is ‘tax treaty gaps.’ Most US persons already live in relatively high tax countries such as Australia, Canada, and the UK, and the US taxes representing double taxation get put on top; so these people pay way higher total tax than US persons with the same income living in the US.

US persons living overseas are tremendously disadvantaged by US tax and compliance policies.

All other countries of the OECD practice Residence Based Taxation. As a result while US persons overseas are tripped up by double taxation, reporting all their accounts, and onerous compliance and penalties; nationals from all other countries are free from such interference from their home countries.

Any US persons living overseas caught up in all this – which very much includes taxation without representation, an American founding principle that the US government has ignored for US citizens abroad – must visit the message boards of The Isaac Brock Society, whose motto is: Liberty and Justice for all United States Persons Abroad. ADCS has initiated legal action against the Canadian FATCA IGA and is seeking donations in its fight against US government injustices against US persons overseas – check it out on The Isaac Brock Website.

Those who criticize those abandoning US citizenship need more education. The US government has created a tangle of citizenship and taxation laws with horrific consequences.

Why should I, a Canadian stay-at-home mother, be required to send my Canadian husband’s financial information and income to the IRS and Treasury (income tax returns and Foreign Bank Account Report – FBAR)? Why should my Canadian government have to collect all of our bank acct. numbers, balances, bank names and addresses annually to the IRS, to do with as they wish, such as share with other US agencies or arms of government? Why do we have to be snooped on by the IRS?

I’ll tell you why. In the early 1960s, my Canadian father living in a Canadian border town next to the US, about to finish high school, was recruited by the US military. After boot camp, he and my mother (Canadian, born in England) married here at home in Canada. I was born in the US (my younger sibling back here in Canada). After my father’s enlistment period was up in 1967, the three of us moved home to Canada. I was registered as a Canadian born abroad with the Canadian government. I spent the first year of my life in the US, and the following 49 years in Canada. I had no desire to be American, ever.

In the early 1990s, I was checking into what the requirements were to be certain I retained my Canadian citizenship. As I lived here at age 25, I was good. That led me to wonder about any clinging US citizenship. Being a poor university student, in the days before the internet, I made a costly long distance phone call to the US consulate in Toronto. During a 30 minute phone call, with varying rude consulate employees, I was finally passed off to the Vice Consul. I was asked a series of questions, such as if I’d voted in Canada, if I’d lived in Canada since I left the US at 1 yr old, etc. I was told I was no longer a US citizen. Cool beans, I only wanted one citizenship…Canadian.

Fast forward to 2010. I discover through news reports the US government has not only created retroactive citizenship law that re-IMPOSES US citizenship on many of us (born but haven’t lived in US, US citizens that moved and obtained citizenship in their new country that were told they lost US citizenship by doing so), but have named people such as myself tax-evading criminals. Why? Because we haven’t been filing tax and bank information returns to a FOREIGN government…the US. I did a lot of research, now thanks to the internet, and discovered this ridiculous situation.

You had better believe I renounced an UNWANTED, RE-IMPOSED. US citizenship. I was lucky to get in when the fee was only $450, and not the $2,350 the State Dept. raised it to last year, to stem the tide of renunciations (which only increased, by the way). Then I was expected to file 5 years of back tax returns, and 6 years of FBARs. Uh, not thanks. Next I was expected to file the EXIT TAX form. Oh, I filed it…with a very nasty letter. I was very much tempted to file it in red crayon, citing my baby bottle and blanket as my assets, since I left the US at a year old, never to return to live.

I have never used US services, except as a tourist on vacation (that has now stopped). I have never applied for, or held, a US passport (why would I, you told me I was not American?). I owe you exactly…NOTHING! You have NO RIGHT to my financial information, or that of my family. None, Zip, Nada.

This has turned my whole family from viewing the US as a friend and neighbour. This has turned my whole family from visiting the US and investing in US companies. I used to defend the US, not a chance now.

In Canada alone, you can probably multiply my situation by about 500,000, since there are reportedly 1 million Canadian “Americans” here.

As the country song says, how do you like me now? You have turned friends into enemies. Only you can stop your out of control government.

this may choc you,

there is no LAW that say ” regular working American” have to pay tax!!.

Tax is due on luxury you have not on your paycheck.

Do your home work.

I was born an American. I am no longer one for over 21 years. I took over 22 years of living solely in another country to realize I did not want to return , work or buy property in the USA. I wanted to vote in the country I chose to live. I never voted in the USA nor had a US passport. When I became a citizen of the country I live in now I relinquished my US citizenship, per the US laws at the time. I ceased to file US taxes on my US tax returns the year I became a citizen of my chosen country. I was one of the rare US persons who knew to file US taxes when living outside of the USA. I never owed America anything. I stopped filing the tax year I became a citizen of the country I live in and have since the 60s. Oh, one year the IRS sent me a US income tax refund for $2,000. I sent the voided check back in registered letter to the IRS. I did not earn any income in the USA and that was an IRS error. I never reached the income threshold to pay taxes to the USA.. My own country’s taxes were much higher than the USA but I had a great union job and Health care that covered almost anything. I have never regretted my choice. I was shocked to find out in 2012 that the USA was citizen based taxation and I may have my bank accounts closed. I found out that the USA is only country that has citizen based taxation as opposed to the rest of the world being resident based taxation. I knew I had to prove I was not American to my banks by going to the US consulate to get my Citizen Loss of Nationality. I had to have an appointment to ask for this and then wait for that CLN paper. It took a year. Then I went to my banks (only in the country I live) and gave them copies of this precious paper that is framed and on my office wall.. I wanted to ensure I would not be asked to close my bank accounts because I was born in the USA>

Being I relinquished it cost me nothing I was lucky that I did not have to pay $450 or the present fee $2,350 and file reports on my bank accounts and income taxes. Penalties for not filing are very huge . I think that citizen based taxation is like the Iron Curtain that keeps Americans from going to other countries. It makes the in a sense slaves. I have declined several opportunities to buy US property… No thanks . I am careful about spending any time in the USA as the USA will want anyone who is not a US citizen to file US taxes if they stay longer than 182 days WITHIN 3 YEARS.

I didn’t see Ted Cruz Canadian citizenship mentioned here in the comments. He was able to renounce by paying $100 and sending a letter. He did not have to go to the Canadian counsel like every American relinquisher /renouncer has too. May the American government see the error of Citizen Based Taxation and let their people freely roam like the other countries in this world.

And yes the banks are asking their customers about their American indica. My manager told me last week but I am not the list. Thank God or my CLN.

Voices of America, eh? Well if you think it’s clever to say good riddance to your fellow (some former) Americans who chose to live outside the borders of the USA, then PLEASE think again. Oh wait, you didn’t think in the first place did you?

I am not and never have been American. I don’t live in the USA and I have no financial connections to the USA. However, many years ago I got a green card when I married an American. We lived in your so-called, Land of the “Free”, until we decided to move permanently to my home country to care for my elderly parents. (Those years of living in the USA without healthcare also played a part in our decision.)

A year or so after my return to my home country my green card expired, became null and void, but I didn’t know I was supposed to return it to USCIS along with an I-407 form. (Green cards don’t come with a set of disposal instructions.) Years later when I found out about this I searched for days to find that old green card and then I sent it away. It was received (according to the mail trace) but never officially acknowledged and there were no replies to my follow-up inquiries. This left me trapped in a perpetual state of deemed US “personhood” which apparently comes with onerous US tax filing and now highly intrusive FATCA reporting too. The threatened penalties for not filing FBAR (FinCEN114) forms are staggering. They would exceed my life savings (mostly a modest inheritance from my non-American parents). If I should ever lose my life savings to the IRS I could end up on welfare and that would not be fair to taxpayers here in my home country.

What did I take from the USA when I left almost 2 decades ago? I took savings of less than $5K and a gain of less than $75K from the sale of the house we built with our own labor and paid for entirely from the savings I brought with me from my home country (no mortgage on that house). All of this was reported to the IRS and taxed appropriately. What do I get from the USA? Absolutely nothing — NO right to return to the USA to live or work; NO US Social Security because I have never had any US earned income; NO rescue by US marines in a disaster (frankly those foreign warriors would scare me); NO US vote; NO representation in the US Congress; and since I haven’t visited the USA in almost 20 years (and never will again), NO benefit from the USA’s crumbling infrastructure. I do not want any of those things anyway. What do I want from the USA? I want to be left alone so that I can lead a normal life without the stigma of being called a “US person for tax purposes” (and ONLY tax purposes).

What’s the biggest irony of my whole situation? Well my husband is no longer American since he relinquished his US citizenship over a year ago. He now has a priceless piece of paper called a CLN (Certificate of Loss of Nationality) which means he can open and retain bank accounts here with no intrusive FATCA reporting. Meanwhile I, who never was American, will have to live with uncertainty for the rest of my life. If my bank finds out about my past connection and failed disconnection to the USA, it will report me and my accounts to my country’s tax agency which will forward that information to the IRS. And then … well I shudder to think what will happen.

Some of you Voices of America may hate me for saying this but I have no respect for what the USA is doing with its irrational citizenship-based tax system and now its FATCA overreach. You might even laugh and gloat about how I became trapped by a bureaucratic blunder as a “US person for tax purposes” (and ONLY for tax purposes) but at least my husband has escaped the clutches of your country. He did so with no regrets and when his CLN finally arrived he felt nothing but relief. I and my country are proud and pleased to have him. His warm and welcoming citizenship ceremony here in my, now OUR, country was one of the best days of both of our lives. Neither of us can fathom why the USA will not graciously let its people go like other countries do … or, as in my case, a person who married one of its people and should, in hindsight, never have agreed to live in the USA for awhile.

Our FATCA laws don’t affect you! What is wrong with you. If you don’t care for America, then fine, we don’t care for you either. Don’t call on us, LIKE EVERYONE ELSE DOES, when the world is in trouble, OK? You were never a US citizen (thank god!), so these laws don’t apply in your country. What is wrong with you!!!! We get it, you guys are happy. That’s great, if only everyone around the world cared that happiness and tranquility are necessary for all of us to enjoy this planet, then people like you will find no need to bastardize any nation for any reason. Your husband was an American………..news flash……he will always be an American and you should always love and cherish him for it! I am an American becuase of the people, not because of the government………AND NOT BECAUSE OF COMMUNIST LAWS LIKE FATCA!!!!! You are just like so many of people in the world who look at Americans because of the government. My country is it’s people, not the government. Remember, when you insult my country, you insult my children. You have the right and priveledge to insult my government all day long, I do! Your husband is the person he is because he was an American, be thankful, and don’t think for a moment that he would have caught your interest to begin with, if he were from another country!

@ one world

So as carefully as I tried to explain that your FATCA laws DO affect me, you had to ignore it all and rant on about me insulting your children. I said I do not respect US citizenship-based taxation (CBT) and FATCA which is the enforcer of CBT. Both are creating great distress for Americans and deemed “US persons” all over the globe. That’s got nothing to do with American citizens or their children. What is wrong with you? BTW my husband is the person he is because he had great American parents and he grew up in my, now our, country. He has spent more of his life here than in the USA. So … news flash … I do not cherish my husband because he used to be American. I cherish him because he is an upstanding human being. Thank you for at least acknowledging that I have the right and privilege to criticize your government (as I do my own) and I will continue to do so.

In 1991 I left the US during a little remembered recession because I needed a job. The plan was to return in two or three years but life went on and I am still outside the US 24 years later. Primarily due to Fatca and recent difficulties with bank accounts and employment I applied for citizenship in the country where I reside and have worked for many years. If the US citizen situation does not become better by next year I plan to pay the $2,350 fee to renounce my US citizenship. I will not be happy to do this but my family depends on me.

Last year I applied for a part-time job as an administrator which requires signatory power over the company’s bank accounts. After being offered the job the company rescinded the offer as it did not want to give its bank account information to a “foreign state”. The company wrote this to me: “we would rather like to find another solution than to open our accounts to a foreign state which might possibly cause other problems since you would be a signatory to the accounts.”

That is Fatca’s impact on one American abroad.

Interesting, still living away. Because of the recession. Interesting. I had no idea that we have been in a recession for 24 years! Where have I been? By the way, your company did not quote FATCA as the reason! Not saying that it isn’t, but you are ready to blame what you assume, which is reckless to begin with. But, living far from home for 24 years because of a recession that no longer exists, then I guess you are far from being reckless. In fact, our best economic years were happening during Clinton’s term. Why didn’t you come home then? Oh wait, did FATCA exist then? Did you have some other reason to blame the US for you not coming home? Let us know, we are anxious to read! In case you may ever wish to look these things up about FATCA, bad people are the reason the low got passed to begin with. And the effect on international banking for expats in so minute, that it really isn’t even an issue. The businesses that wish to not get entangled with anyone who may involve FATCA has something to hide! FATCA does not control foreign banks, you ignoramous!

When 7 million people in the industrialized work can’t have banking privileges, it is not “minute.”

one world, you seem to be filled with anger? Anger at poor Americans living overseas, because we have been grievously harmed by our own government? So, you are blaming the victims here, who are fellow Americans? Belittling and denigrating them? Insinuating that all the posters commenting here are liars, if their comments do not agree with your views? Why harass the poster Working Abroad? He or she has already answered your insinuation-filled diatribe / question / accusation (I have added CAPITALS for emphasis in the following quote): “The plan was to return in two or three years BUT LIFE WENT ON and I am still outside the US 24 years later.” What’s so hard to understand in that sentence? It’s obvious to me that this person found a life in another country that he or she did not initially expect and has adapted to the new situation and made a home in that country.

You say, “Did you have some other reason to blame the US for you not coming home?” But don’t you understand? This person has made a home in another country.

You say, “By the way, your company did not quote FATCA as the reason!”

Uh, yes he or she did: “we would rather like to find another solution than to open our accounts to a foreign state” By a simple process of elimination, the only possible “culprit” is the US, since no other country is forcing overseas companies to “open their accounts to a foreign state”. Very well documented, sorry.

You also state, “In case you may ever wish to look these things up about FATCA, bad people are the reason the low got passed to begin with.”

Unfortunately, you seem to be naive to an extreme. Do you think everything the gov’t does is just and right? Have you ever heard of “civil forfeiture” which is basically legalized stealing of people’s honest assets by the gov’t (law enforcement to be precise, but don’t worry, the “goodies” get spread around – google it if you don’t believe me)

You say, “And the effect on international banking for expats is so minute”

If you really are overseas and your bank accounts have not been affected by FATCA, then lucky you. All of the problems you can find discussed here exist and are well documented.

You say, “FATCA does not control foreign banks”

You are correct, sort of: FATCA, in fact, is a US law that forces the foreign governments in question to force their own banks to turn over information to the US under penalty of the US taking (although many would define that as “stealing”) 30% of international dollar transfers. Not sure what your definition of “control” is, but mine has something to do with being forced to do something against my will (and, frankly, against all common sense).

You say, “you ignoramous!”

“People who live in glass houses should not throw stones” is my only comment.

You seem to be someone who likes to argue without actually knowing the pertinent facts, so it is probably a waste of time to suggest that you inform yourself. But here goes anyway: inform yourself.

You can find extensive information at isaac brock society (google it).

While you’re at it, you can also google the meaning of the terms jingoist and jingoism (not to be confused with patriotism)

Working Abroad, is there a reason why you did not relinquish (or perhaps you’re still in time to do so)? (the fee for relinquishment is $0). You can find more information on the internet. Specifically, check out a society by the name of isaac brock.

The fee is $2350 or 23 percent of everything you own if you have over $2 million assets. Most expats believe you pay taxes where you live not where you were born.

You are confusing two issues…citizenship and taxation. $2,350 is owed to the State dept., to renounce one’s citizenship. The other issue you mentioned is taxation…the Exit Tax…administered by the IRS and Treasury, the form required to obtain a finalization of US tax obligations as a citizen.

As the US ties citizenship and world-wide taxation together in a single bundle, it is easy to become confused.

It might be useful if the author, Dora Mekouar, shared these comments with the relevant committees in the House of Representatives and Senate overseeing FATCA and other abusive legislation that in essence criminalises American citizens living abroad. Even US citizens living abroad who have faithfully reported their accounts to IRS — even before FATCA — and paid the taxes due are now subject to a discriminatory and confiscatory tax regime if they hold mutual funds abroad. Capital gains on these accounts are treated as earned income even though they clearly are not and then tax at rates up to 50 percent. It is especially ironic that this occurs when the US Congress allows millionaires pay 15 to 20 percent on earned income through various stock and deferred income schemes. The US tax system and the Congress that oversees that system are both fundamentally corrupt. Time to clean both of them up. Perhaps US Citizens abroad should create a PAC and buy a few Congressmen of their own….

Lets face another fact: the world opinion of the United States of America is most of the way down the toilet. It may be the land of opportunity for many, but most people around the world consider America a bully. You can blame it on the rest of the world’s ignorance of what true freedom means, if you want to. Most Americans seem to. Regardless, America has 8 million citizens living abroad. We are de-facto plenipotentiaries with boots on the ground. We live in foreign countries and we tell the rest of the world America’s story. And right now that story is not so good. When discussions of America come up at water coolers, coffee shops, parties, or pubs, we’re the first to throw gas on the fire. We’re the most vocal of all the many USA haters. This is an intangible price you can blame on yourselves.

Please do not forget FATCA’s other impact – access to normal banking. As an American expat many banks are denying services to me because FATCA makes dealing with Americans risky. I have been denied a mortgage because of FATCA. My ability to invest for retirement is limited. Many Americans are denied jobs or promotions because it may expose the company to FATCA laws. Some people have had their mortgages cancelled. FATCA has put us expats in the position of choosing to live a normal life or retaining U.S. citizenship. Not a fun position to be in.

Funny how I have been living outside the US for over half my life, in many different countries, right now in Japan. Never have I have ever been denied credit, loans, or any other banking services when dealing with foreign banks. I must be one of the lucky ones! No, wait, I pay my taxes, hate it, but I do. Blaming FATCA for your life’s struggles is irresponsible.

Hmmm…FATCA is just going into effect. Did you read some of the stories. I was just threatened as an EX American with closing of my account because I send $300 to America. My husband has been denied an account because he is American. Societé Générale is closing the accounts of American. None of the people I know is wealthy.

Saverin was originally from Brazil. He paid 23% of his fortune as do all people with over $2 million who surrender their passport.

Now if you move from the State you were born in to another would you be willing to pay taxes on everything you earn to BOTH states? Especially if you were never returning. Would you really like to pay off your mortgage in 30 days? This is happening.

You are right. AXA has also closed accounts of US citizens. Boursorama (French online bank that’s owned by BNP paribas) won’t open accounts if you are a US tax payer (they will ask during the application), same with ING Direct France. UBS (Switzerland) has said that they will only open basic accounts for US citizens (checking and savings), but they won’t open investment or retirement accounts.

And yes, you are correct, I read somewhere online that banks will monitor your banking activities, they are suspicious of any money transfer to the US or any foreign transaction occurrence in the US. To them, that’s indicative of strong ties to the US. On a different forum, another guy said that he wired money to one of his relatives in the US and his bank contacted him to inquire what was that about.

Good for you. However, do not dismiss other people’s experiences just because you don’t have them. It’s been reported that many Americans have had their bank accounts closed because of FATCA. Not because you haven’t had any issue yet doesn’t mean that others don’t. I have heard people say they haven’t had any issue so far. Also, it doesn’t mean they people don’t pay their taxes.

I have read some of your others posts, some of the points that people make go right over your head. Learn how to read. Andrew’s not blaming FATCA for his life’s struggles, nowhere did he ever say anything about his life struggles. He mentions how banking services are difficult to access because of FATCA. A simple google search will tell you how many Americans expats have had issues opening bank accounts since FATCA was implemented. Stop dismissing other’s people experience, these issues have been widely reported.

Bring it on with all the anti-American comments here. We wewlcome that, we are Americans. No where else in the world will you find people that will pay the ultimate sacrifice for you to hate this country, and to hate those that defend it for people like you. And for the irresponsible reporter that published this non-sense article. SO WHAT….LEAVE…..GOODBYE!!!! This article makes about as much sense as dropping one Corn Flake out of your cereal bowl and considering that a major issue that needs serious discussion. Still doesn’t change the fact that more people are coming to this GREAT NATION than any other nation in history. These people that are giving up their citizenships for money reason are just spoiled little brats! Goodbye, good riddance. 1,300 people? Wow, such a large number to lose sleep over. How many joined ISIS. How many are tax-evasers? How many Americans give a hoot that someone wants to give up on us, all of us! Will that help with the traffic congestion?

So do you think that the co-founder of Facebook, Saverin, could have renounced his AMERICAN citizenship, if he didn’t get rich off of AMERICANS????? Wish I had known this beforehand, but I already deleted my FB page, found it too time consuming and taking too much time away from real conversations. Hey Saverin, I don’t see any of the 99% in this survey of American abandoners! I really enjoy the way hypocrisy is the norm nowadays. Saverin used Americans to get rich enough to renounce his citizenship, and now offers oratories of how bad America is! There are plenty of choice words that people like Saverin deserve to be called, but we must be adult here. Dang! Here is a prime example of why the 1% are simply spoiled little brats: In Virginia, the incoming governor promised to reduce the property taxes. Property taxes are usually associated with of well or awesome income ranges, people in poor communities don’t have to worry with property taxes. So…..the governor won the bill to reduce property taxes. Huuray you say? Well, the tax cost of prepared foods, such as McD’s, BK, etc, went from a meager 7.5% to a whopping 12%. Few noticed, but the majority of fast food consumers are those in the 99% range, the low to poor incomers!!!!! Yes, the wealthy got their way with property tax reductions, and the poor picked up the tab! And he was a Democratic governor! Where were all your voices then? Or were you just like the rest of the wealthy that care only with what you can get away with and who cares who has to pick up the tab for you!

Ironic username.

One world.

You wrote:

“So do you think that the co-founder of Facebook, Saverin, could have renounced his AMERICAN citizenship, if he didn’t get rich off of AMERICANS????? ”

I found in Wiki that Eduardo Saverin was born in São Paulo, Brazil, to a wealthy Jewish Brazilian family and his family later moved to Rio de Janeiro. Eduardo’s father, Roberto Saverin, was an industrialist working in clothing, shipping, and real estate. His mother, Paula, was a psychologist and he has two siblings.His Romanian-born grandfather, Eugenio Saverin, is the founder of Tip Top, a chain of kidswear retail shops. In 1993, the family emigrated to the US, settling in Miami, Florida.

Eduardo was 11 years old when he moved to the USA with his family. He was 29 in 2011 when he renounced his American citizenship. He was well off before he came to the USA as a child. and more well off when he left.. He paid over 23 percent of his assets to renounce his US citizenship . He moved away to Singapore 2009 and must have found where he moved to was more conducive to his goals in life. Also note that Singapore does not allow dual citizenship. When you obtain PR status you do not become Singaporean. You are just a permanent resident in Singapore, and you keep your original citizenship. If you want to become a Singapore citizen, you have to give up your original citizenship. Obviously he wanted to be a Singapore citizen. It is his right to choose…Isn’t that the American way? to be able to choose.

One World, you wrote: “Wish I had known this beforehand, but I already deleted my FB page, found it too time consuming and taking too much time away from real conversations. ”

One World . It did not take me but a few moments to find this information… You would be surprised how much of the truth you find on the internet, FB included and looking up the answers is quite quick and simple. I have loved the internet because I think it is my personal library to access information, trite or serious. I can find a movie listing or look up Glio Blastma Multiforme and its treatments, when my son was diagnosed with it.

One World, You said: “Saverin used Americans to get rich enough to renounce his citizenship, and now offers oratories of how bad America is! ”

I have not found anything on the internet where Saverin is badmouthing the USA. It would be helpful if you pointed out where he is. But you seem to be badmouthing everyone who has written here.

BTW. It took me 24 years living in another country before I made the serious decision to give up my US citizenship. I never voted in the USA but I did want to vote in my adopted country. That was over 22 years ago. I have not lived in the USA in over 46 years. Since going to live in my adopted country I filed my US tax returns as well as my adopted country’s faithfully. the most I made a year was $40k and that was before relinquishing. In the 90s I made about $30 k. WHen I became a citizen of my adopted country I stopped filing US taxes the tax year I became a citizen of it. The US rules then were I relinquished my US citizeship.

I am no Saverin… Why did I give up my US citizenship? I felt the quality of life I was living was more beneficial to me. I had excellent health care that was available to all my fellow citizens without paying a lot of money or being denied because of my health conditions. I saw too many American friends and relatives go bankrupt in America over medical bills. I had an excellent union job in my adopted country and by the time I relinquished I saw that the US middle class was in a decline. The unions were being destroyed. My American friends and family were having very hard times just making ends meet. Many were being laid off or declining in health due to less good health benefits, if any. They were having to have too many spaghetti dinners to raise funds for loved ones’ health treatments.

One World, you wrote:

“There are plenty of choice words that people like Saverin deserve to be called, but we must be adult here. Dang! Here is a prime example of why the 1% are simply spoiled little brats:”

You have an angry attitude and it appears you have not actually read and understood what I and my fellow expats have written. Many would like to stay American but for most being middle or lower class it has become too expensive. to file US tax returns, with needing a tax professional to file these US tax returns when no taxes are needed to be paid. The tax compliance agent will charge thousands to do this. It is also unfair that they must report their bank accounts , banks down the street from them. each and every year. Homelanders do not have to do that. The USA makes it very difficult for its citizens to remain dual . Citizen based taxation is hurting America. It is preventing many from going abroad to work or attend school, due to banks not wanting them as customers or companies to hire them.

One world, You wrote:

“In Virginia, the incoming governor promised to reduce the property taxes. Property taxes are usually associated with of well or awesome income ranges, people in poor communities don’t have to worry with property taxes. So…..the governor won the bill to reduce property taxes. Huuray you say? Well, the tax cost of prepared foods, such as McD’s, BK, etc, went from a meager 7.5% to a whopping 12%. Few noticed, but the majority of fast food consumers are those in the 99% range, the low to poor incomers!!!!! Yes, the wealthy got their way with property tax reductions, and the poor picked up the tab! And he was a Democratic governor! Where were all your voices then? Or were you just like the rest of the wealthy that care only with what you can get away with and who cares who has to pick up the tab for you!”

One world, I am not wealthy. I get no US pensions, No US investments, have no US property. I have nothing to tie me to the USA but being born there and memories of going to school and distant relatives. I am retired now and make $20k annually. My American friends and family are not wealthy either, yet they pay property taxes. I too am concerned for the low to poor incomers. I agree with you the wealthy do get away with less taxes since the politicians have gerrymandered voting districts and made the taxes go lower for the rich.. Corporations are people! Now they want to take money out of Medicare to pay for TPP. They want to get rid of social security. They want to raise the age of retirement. to 67. (I retired at 57.) They want to get rid of ACA. and go back to the emergency room treatment to those who have no health insurance. You should be angry. Not my idea of fairness. I guess I saw the writing on the wall and left in the 90s while the going was good.

You feelings are bitter. but you are hating the wrong people. We Ex Pats only wish to live a happy life. 99 percent of Americans abroad are NOT rich. We are not tax evaders.