In this Monday, Sept. 23, 2013 photo, a pump jack works beside the site of new home construction, in Midland, Texas. (AP Photo)

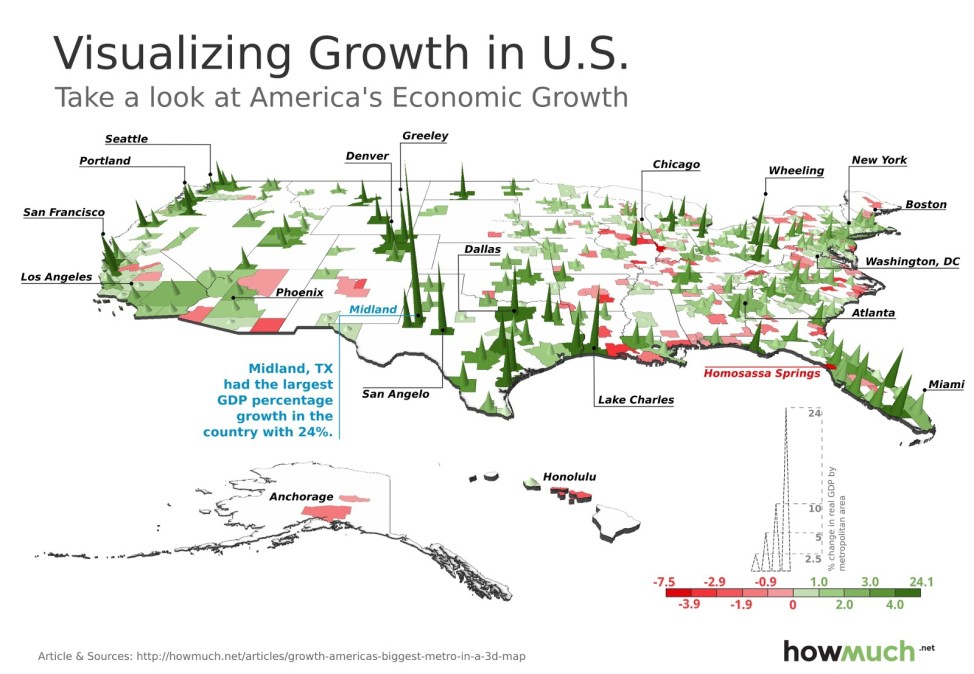

The GDP in the United States increased 2.3 percent in 2014, but some metropolitan areas flourished more than others, according to the Bureau of Economic Analysis.

Midland, Texas, had the highest GDP growth of any metropolitan area in the United States with a 24-percent increase. The city sits atop the Permian Basin, one of North America’s largest oil reserves. However, that oil was contained in deeply embedded rock formations that remained untouched until the city began using hydraulic fracturing — known as “fracking” — to extract it.

“When people figured out how to [produce oil] through fracking, that was the game changer,” Midland Mayor Wes Perry said in a 2013 interview.

All in all, the longhorn state is looking particularly prosperous. The highest overall growth in a top 10 U.S. metro market was in the Dallas area, which increased by 8.5 percent. San Angelo, another Texas metropolitan area, came in second in the nation with GDP growth of 11.4 percent.

The Gross Domestic Product (GDP) is the monetary value of all goods and services produced within a nation’s geographic borders.

At 1.5 trillion, the New York area has the highest GDP in the country, but it only grew by 2.4 percent. Los Angeles has the second largest GDP at $866 billion, an increase of 2.3 percent over 2013. Chicago was third with $610 billion and growth of 1.8 percent.

The industry with the highest growth overall was professional and business services.

The cost information website, howmuch.net put together the map below, which shows GDP growth by metropolitan area. The higher the cone rising out of the map, the greater the GDP growth in that area.

The US economy continues to grow at a sluggish rate in a slow recovery and in relative domestic tranquility as the rest of the world is in a sea of trouble and turmoil. There is hardly anywhere else on the globe you don’t see it. The US will increasingly be seen as a haven for those who have the means and desire to flee from where they are. Unwittingly the US government has pushed the reset button on world geopolitical and economic relationships and along with unexpected events such as the rise of Islamic terrorism and an enormous drop in oil and gas prices has returned the world back to where it was in the 1960s. The US Fed raising interest rates will only accelerate the process. Among the most vulnerable places to put money is London’s overbloated real estate market that has been a haven for many with ill gotten gains. Investments in so called emerging markets will also be very vulnerable. These include the so called BRICS nations with the possible exception of India.

Really GREAT that US prospers!!! How about national debt? How would US resolve its debt in near future?