When faced with the prospect of a Donald Trump presidency, some Americans have threatened to leave the country, but most of that grumbling is probably just talk.

However, there is a small but growing number of Americans who are following through on a pledge to renounce their citizenship, but it’s likely for other reasons. While millions worldwide clamor for the opportunity to come to the United States to pursue the American dream, more U.S. citizens than ever are giving up their passports.

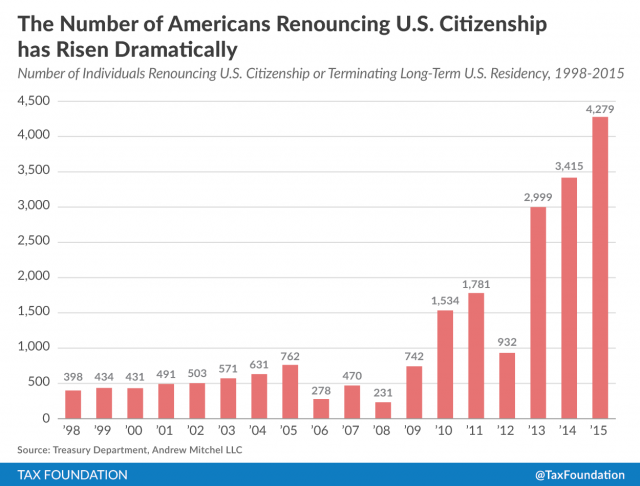

In the first three months of 2016, 1,158 Americans dumped their passports. In 2015, there were about 4,300 expatriations, a 20 percent increase over the previous year, the third record-breaking year in a row.

In the first three months of 2016, 1,158 Americans dumped their passports. In 2015, there were about 4,300 expatriations, a 20 percent increase over the previous year, the third record-breaking year in a row.

Why would anyone want to give up a passport that is arguably one of the most coveted in the world? Some take the drastic measure because they have deeper ties to other countries, some of which don’t allow double citizenship.

However, a complicated tax system appears to be motivating many of these defectors.

The U.S. Foreign Account Tax Compliance Act (FATCA) is global tax law enacted in 2010 after being in the works for a number of years. The law requires that banks in foreign countries disclose all Americans with accounts containing more than $50,000.

American citizens are required to pay taxes on their worldwide income, whether they live in the United States or not. For Americans living abroad, that could mean paying taxes twice, both in the country where they work and live, as well as in the United States, the country of their citizenship.

In a letter to first lady Michelle Obama published on his blog, one former citizen who gave up his passport protested the double taxation of Americans who live and work abroad.

“They are chattel. They are economic slaves,” he wrote. “Yes, no? I love being treated as a slave. I live, work, and pay taxes in Canada, yet my master needs his payment. The concept is against everything I consider American.”

And getting out isn’t cheap. While giving up your citizenship is free in some countries, the fee to extricate oneself from the United States keeps going up. At last tally, it cost $2,350 to hand in your passport and walk away.

More About America

Move Over Millennials, Here Comes iGeneration

Goodbye Ketchup, Hello Sriracha! How Immigrants Transform US Cuisine

Millennials Beat Baby Boomers as Largest Living US Generation

What Your First Name Reveals About Who You Support for President

Trump Says American Dream Is Dead, Is He Right?

It might be tough to pay so much tax, however in my opinion it is a small price to pay to have a so coveted passport. I would pay happily if I had the opportunity to become American.

It all depends what country you are in. There are many countries such as Canada, Australia, the UK that have lots to offer. If you already live in a place you may end up calling it home. The longer you live outside the US the more aware you become of the intrusion and injustices of the US Double Taxation and Compliance – compared to nationals from all other OECD countries who may live in the same street in your nonUS country and don’t get chased by their countries of birth.

I agree. If you live abroad long enough, it can be hard to re-adjust to living in the US. There are many countries in Europe that have tax treaties with the US. However, even those governments have been bullied by the US to divulge American citizens’ assets. This includes people who happened to have an American parent and have never lived in the US nor have any interest in doing so. The consequence is that those with dual citizenship are being discriminated against in their second country when banks refuse to let them open a new banking/checking account.

What countries do Americans who both they and their parents were born in the USA move to as adults?

You can move to any country that accepts you as a retiree and possibly obtain citizenship. Or, you can get married to a person from another country, move there, and get citizenship. Depends on the country. In some countries it is not difficult. In other countries, there is no way you can get citizenship.

I have regretted the ambiguity of my question. What I was trying to get at is: what countries do people who are thoroughly American but feel that another country’s way of life or part of its culture is more suited to their personality move to the most frequently?

Under Obama the amount of Americans giving up their passports has gone from over 700 in 2009 to over 4,000 in 2015. I can only wonder why….

Nice try to blame it on Obama. It’s his last year in office and everyone knows that, so why the heck would he be the reason? That’s a stretch if I ever heard it.

President Obama has been in office for two terms. His administration has increased the enforcement of FATCA significantly and has demanded, with a threat of withholding 30% tax on all financial transfers to financial institutions in other countries, that other countries sign Intergovernmental Agreements (IGAs) to assist the U.S.in the enforcement of FATCA. That enforcement and the US’s continuing practice of Citizenship-Based Taxation are the main reasons that people living outside the US are ditching their US citizenship in record numbers.

The US has built a virtual Financial Berlin Wall to keep US persons in by punishing harshly those who have left – even those gone decades – all in the name of tackling US resident tax cheats with an account(s)/assets overseas.

The US Constitution did not confine liberty and the pursuit of happiness only to those US persons resident in the US. In an increasingly global and mobile world the US should not punish and disadvantage US persons living, working overseas, and expanding US influence and trade overseas.

The situation of US persons tax resident abroad:

Double Taxation (county of residence + US tax via tax treaty gaps)

Without Representation (would never have agreed to it all)

Without US Government Services (that US resident US persons may receive)

Without a Care By The US Government For One’s Well Being (only about stick and compliance)

With Unfathomable Compliance (obligation to overlay the 74,000+ page US tax code on top of the tax code of one’s country of residence – with inevitable tax treaty gaps through which double taxation flows through).

With Excessive Compliance Cost (see above – it all requires highly specialized assistance and can’t be done with TurboTax, and you don’t use that because of the potentially bankrupting penalties (that US residents do not face for their everyday accounts in the US if not done right).

With Excessive Compliance Penalties (The U.S. tax rules punish accounts and investments that are foreign to the USA. The compliance penalties for not reporting accounts right could be bankrupting even if no US taxes are owed)

It is all UnAmerican, has nothing to do with ‘liberty and justice for all”, it is unfair and wrong!

Any US persons living overseas caught up in this must visit the message boards of The Isaac Brock Society and Facebook Citizenship Based Taxation and American Expatriates Groups; and consider supporting the Canadian FATCA IGA Lawsuit and contribute to citizenshiptaxation dot ca .

US citizenship should be about the greatest liberty in the world. Yet the truth is US persons living overseas are tremendously disadvantaged by the US government compared to nationals from all other OECD countries. The US should join the OECD and adopt Residence Based Taxation.

The increase in renunciations is mainly due to the U.S’s. Citizenship-Based Taxation (CBT) laws, contrasted with the Residence-Based Taxation (RBT) laws of all other countries except Eretrea. If the U.S. would just change to RBT, the exodus of “defectors” (your word) would largely end. Instead, the U.S. has increased the outflow by enacting intrusive legislation (FATCA) that requires financial institutions abroad to reveal details of their U.S. citizen clients’ financial holdings — even in their countries of residence and other citizenship — to the IRS. That, plus the cost of paying accountants to file annual U.S. tax and FBAR returns, is driving the increase in renunciations and generating lots of ill will toward the U.S. government.

I renounced in December 2015. First, I left the United States as a small child. I have NO understanding of what it means to be an American. I have always identified myself as a Canadian. Indeed, I have held Canadian citizenship for decades and I have always used a Canadian passport. Eons ago, US citizens taking citizenship of another country were told that the US did not recognize dual citizenship. I believed that I had lost mine. Really very shocking to find out that they now recognize dual citizenship. I was never advise that it was necessary to send a letter to the State Department and you could renounce for free. Since 2014, it will cost you $2,350 or $3,320 Canadian. In fact, I didn’t even have a social security number. I left the US long before they began issuing them to children. When I found out about FATCA, I didn’t even have a social security number so that I could file. I couldn’t enter the US on a Canadian passport and didn’t have a US passport. The closest Social Security office was 18 hours by car away. Thankfully, they (US) started taking appointments at Consulates to help individuals do the paperwork for a number. We are not rich. I am a book keeper and my husband is a warehouse supervisor. We have (1) vehicle. I walk to work everyday. Our house was built in 1979. And yet, it cost me $15,000 to get compliant and renounce. I owed NO taxes. I worked more than (1) job last year to correct this situation. We are not entitled to anything from the US. People say to me “but you could live there.” Wrong! What am I going to do about my husband (Canadian), my mother – in – law, who is elderly with Parkinsons, my children who are young adults, but not Americans? “They’ll come save you if you need to be rescued.” Yes, then they’ll send the bill. “You could vote and try to change this bad law.” I believe that it would be irresponsible of me to vote in the US when I don’t live there, nor understand the problems many of it’s good citizens are faced with on a daily base. One more thing, in an economy that is struggling, I had to go to my Canadian boss (with Scottish roots) and tell him that America wanted to know all about his accounts that I sign on as his bookkeeper, where they are kept, account numbers, highest balances, his SIN number, etc. I was scared that he would let me go. I know may others like me…Safeway Deli clerk, barber, beautician, church secretary, dental assistant…just plain folks trying to make a living.

Your immigration programs is just for some people not for important which are worked for us ,programs I am sorry I worked more projects of u said of USA but my request not expect for the IVC program I want to give the some important people which are under threat of alqaida bacuas they’r work ed for us program

I’m Engineer inspector and worked more than 9 year in international project I am target now.

It seems ironically unfair that US corporations can move offices offshore to avoid taxes but private citizens are taxed twice while working abroad. Didn’t the US Supreme Court recently pronounce corporations as “people”? It seems to me real people should have the same tax exempt privileges as corporations or corporations should be taxed the same as people.

Well done.

If you get kidnapped by IS you are on your own!