FILE — A relaxing retirement might not be achievable for all Americans. (AP Photo)

Both of the leading presidential candidates, Hillary Clinton, 68, and Donald Trump, 69, are pushing 70, an age when most Americans traditionally contemplate retirement, rather than seek one of the world’s most stressful and demanding jobs.

But Clinton and Trump could be on to something. More than half of older Americans are expected to keep working past the traditional retirement age of 65, according to a recent survey. The reasons vary: some can’t afford to retire while others prefer to stay active.

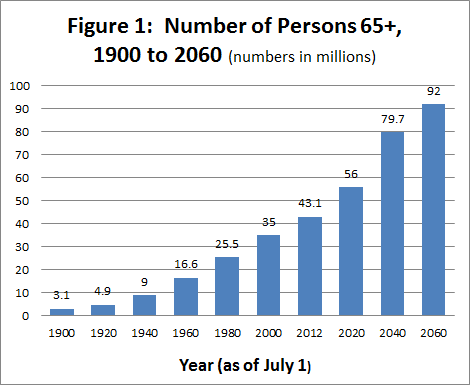

Source: U.S. Census Bureau, Population Estimates and Projections/US Department of Health and Human Services

As the baby boomers — people born between 1946 and 1964, who are currently between 52 and 70 years old — begin to reach age 65, the United States’ general population will have more older people than ever before.

The 65-and-older crowd jumped from 35.5 million in 2002, to 43.1 million in 2012, an increase of 21 percent. That number is expected to more than double by 2060, to 92 million. By 2040, there will be twice as many older people living in America than there were in 2000.

The survey included interviews with 1,075 people who were age 50 and older. One-fourth of the older workers said they never plan to retire, and that’s truer among low-income earners than high earners. Thirty-three percent of people earning less than $50,000 a year said they’ll keep working indefinitely, while 20 percent of those with salaries over $100,000 said they’ll never retire.

Sixty percent of people aged 50 to 64 said they expect to work past their 65th birthday. More than half of those who are already older than 65 said they plan to keep working, too. However, many of these older workers are putting in fewer hours, an average of 31 per week.

Being older doesn’t necessarily mean these employees are complacent. A majority of older workers — especially those who are 65 and older — plan to switch employers, or move into an entirely new profession, as they head off into the twilight years.

More About America

Record Numbers of Americans Ditch Their Passport

Move Over Millennials, Here Comes iGeneration

Goodbye Ketchup, Hello Sriracha! How Immigrants Transform US Cuisine

Millennials Beat Baby Boomers as Largest Living US Generation

What Your First Name Reveals About Who You Support for President

I luv the retirement life, it’s the best. I retired @ 50 and don’t have plans of going back to work EVER.

I’m wondering how these retirement findings compare with other nations.

I would love to retire in ten years from where I currently work. Travel for about a year and then work somewhere for three days a week or even work from home. I am very active and have a lot of extra curricula activities that I participate in.

That is the plan, I just hope I can afford to retire…..

I think that it is significant that many older workers are working 31 hours per week. This makes a lot of sense. By then their children are grown and they no longer have that expense to worry about. Doing absolutely nothing can lead to a lazy style of life that is actually not good for one’s health. Continuing to work can lessen the need for social security benefits to get by with normal expenses. When the retirement ages were introduced, we did not have so many labor saving devices and life was more physically demanding. It makes sense, then, in many cases, that people are avoiding full retirement.

I tried retirement at 66, it lasted for 12 months then I got so bored that I willingly returned to work. In Australia, we are eligible for an old age pension (in my age group) at 65 years. My wife and I receive AUD $1200 per fortnight and I add AUD $600 per fortnight which causes me to lose about $60 per fortnight from our pensions. Life is very good down under.

A mid-2014 Federal Reserve report stated findings that less than half of Americans could come up with $400 in an emergency without taking out a loan or selling possessions. The report also found that among those Americans who had savings prior to 2008, nearly two-thirds of them had either depleted, or used a substantial amount of that savings during the ‘Great Recession’, leaving tens of millions within twenty years of retirement without any real savings, pensions, or hope of affording retirement. Saddle that with the unreasonable expectation of society that all the moms and dads are responsible for dipping into their retirement savings to fund college educations for their children. The report also stated that only about 39 percent of all Americans could come up with an amount equal to three months pay, to survive if they lost their jobs. Those must be the people Affluent enough to house the third of 18 to 34 year old Americans still living in their parents’ home? To tell you the truth, it seems like the baby boomer generation forgot all the sound economic advise their parents and grandparents, survivors of the great depression era, gave them about thrift, good economy, and value. There is an underlying hint to this article of hard times to come, with problems in the social security system, and virtually no pension systems left in either private or government sectors. Sadly, these problems with financial security will probably hit the millennial generation the hardest. They seem to be an American generation just one paycheck away from living in a box under a freeway overpass.